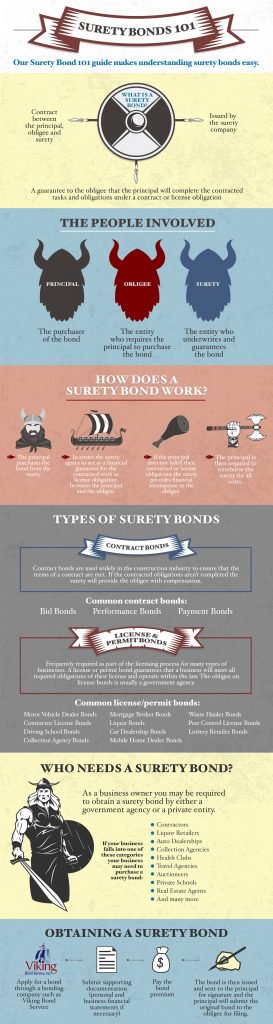

One of the most commonly asked questions about surety bonds is in regards to the payment terms, after all, expenses and cash flow are hugely important to a business! The first step in understanding how surety bonds are paid is to look at the application process as a whole. To apply for a surety bond you’ll submit a surety bond application with information about your personal and business finances. This information is used to calculate your bond premium. In general, bond premiums range from 1% to 5% of the bond amount for people with good credit and 5% to 15% for those with poor credit.

Continue reading “How are surety bonds paid?”