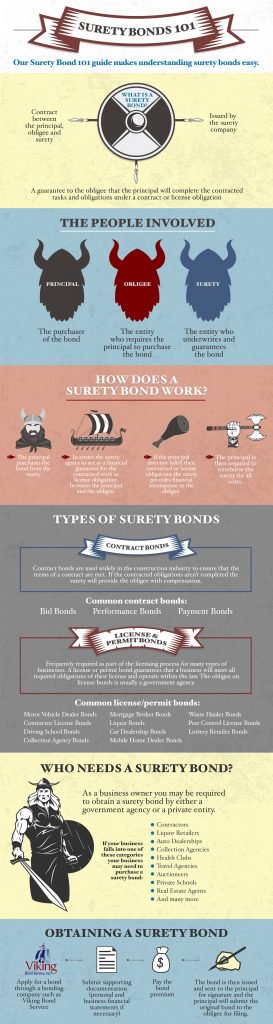

Our Surety Bond 101 guide makes understanding surety bonds easy.

Share this Image On Your Site

The people involved

There are three parties involved in a surety bond:

-The principal is the purchaser of the bond

-The obligee who is the entity who requires the principal to purchase the bond

-The surety is the entity who underwrites and guarantees the bond

What is a surety bond?

-A surety bond is a contract between the principal, obligee, and surety.

-It’s issued by the surety company.

-And a guarantee to the obligee that the principal will complete the contracted tasks and obligations under a contract or license obligation.

How does a surety bond work?

-The principal purchases the bond from the surety.

-In return the surety agrees to act as a financial guarantor for the contracted work or license obligation, between the principal and the obligee.

-If the principal does not fulfill their contracted or license obligations the surety provides financial recompense to the obligee.

-The principal is then required to reimburse the surety for all costs.

Types of surety bonds

Contract Bonds

Contract bonds are used widely in the construction industry to ensure that the terms of a contract are met. If the contracted obligations aren’t completed the surety will provide the obligee with compensation.

Common contract bonds:

Bid Bonds

Performance Bonds

Payment Bonds

License and Permit Bonds

These bonds are frequently required as part of the licensing process for many types of businesses. A license or permit bond guarantees that a business will meet all required obligations of their license and operate within the law. The obligee on license bonds is usually a government agency.

Common license/permit bonds:

Motor Vehicle Dealer Bonds

Contractor License Bonds

Driving School Bonds

Collection Agency Bonds

Mortgage Broker Bonds

Liquor Bonds

Car Dealership Bonds

Mobile Home Dealer Bonds

Waste Hauler Bonds

Pest Control License Bonds

Lottery Retailer Bonds

Who needs a surety bond?

As a business owner, you may be required to obtain a surety bond by either a government agency or a private entity. If your business falls into one of these categories your business may need to purchase a surety bond:

Contractors

Liquor Retailers

Auto Dealerships

Collection Agencies

Health Clubs

Travel Agencies

Auctioneers

Private Schools

Real Estate Agents

And many more

Obtaining a surety bond

- Apply for a bond through a bonding company such as Viking Bond Service

- Submit supporting documentation (business resume and financial records if necessary)

- Pay the bond premium

- The bond is then issued and sent to the principal for signature. Once all parties have signed the bond, the principal will submit the original bond to the obligee for filing.