If you’ve been interested in opening up your own business, you may have heard of a sales tax bond. Sales tax bonds play an important role in making sure sales taxes are properly handled. Let’s take a look at some of the basics of sales tax bonds, then dive into who may be required to post such a surety bond. Continue reading “Who Needs a Sales Tax Bond?”

Tag: Surety Bond

What is an SDDC Bond?

If you’re a Transportation Service Provider (TSP) who is looking to transport Department of Defence (DoD) freight, you’ll want to familiarize yourself with SDDC bonds. Military Surface Deployment and Distribution Command performance bonds give financial assurance to those looking to hire TSPs for military freight distribution. In this post, we’ll explore some of the basics of this bond so you can gain a general understanding of its purpose. Continue reading “What is an SDDC Bond?”

What’s Brewing in Iowa? New Brewer’s Bond Requirements

In September of 2018, the state of Iowa enacted new surety bond requirements for those looking to craft and sell alcohol in the state. This change primarily affects “Class A” and “Special Class A” beer and wine permit holders in the state. If you’re in the craft beer, wine, or liquor business, you may want to familiarize yourself with these new rules. In this post, we’ll take a general look at these changes, so that you can make sure you’re well equipped to follow the alcohol regulations of the state. Continue reading “What’s Brewing in Iowa? New Brewer’s Bond Requirements”

Surety Bonds vs. Insurance Policy

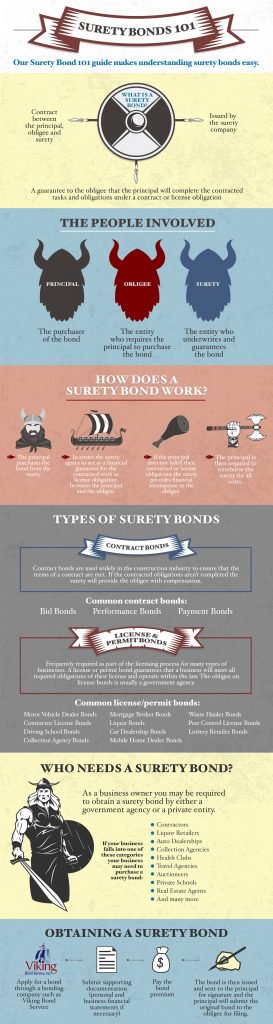

You may have heard about surety bonds but aren’t exactly sure what they are… Many people get confused between insurance vs. bond. While they appear similar, they can have very different implications for both businesses and consumers. The team at Viking Bond Service is here to clear up the confusion by explaining the difference between surety bond vs insurance policy.

The Basics Of Pest Control Bonds

Pest control bonds are designed to protect consumers and ensure that any business that uses pesticides obeys all state and federal regulations regarding the use of these substances. These license and permit bonds need to be maintained as long as the business remains operational. Continue reading “The Basics Of Pest Control Bonds”

Types of Surety Bond Collateral

Surety bond applications generally only require a business to submit an application form, supporting documentation, and the premium amount in order for the bond to be underwritten. However, there are some circumstances where a surety may require the applicant to provide a form of collateral to secure the bond. This generally occurs when a surety bond deems that the risk of issuing the bond is too great without the additional protection of collateral. Continue reading “Types of Surety Bond Collateral”

Top Surety Bond Myths

Surety bonds are often misunderstood both by the business who needs a bond and the person or entity trying to make a claim against one! We’ve highlighted the top three surety bond myths to help you understand how surety bonds work:

Surety Bonds Vs. Letters of Credit

Surety bonds and letters of credit are both used to manage risk and provide a form of financial guarantee for the people and organizations your business works with. If you’re not sure whether a surety bond or a letter of credit is a better choice for your business needs we’re here to help you understand your options!

Everything You Need to Know About Oil and Gas Bonds

If you own a business that operates in the oil and gas industry you’ve probably already heard of surety and gas bonds. Whether you’ve had experience acquiring a bond before or this is your first time our oil and gas bond guide can help you understand everything you need to know about these types of surety bond.

Continue reading “Everything You Need to Know About Oil and Gas Bonds”