If the courts have ordered you to acquire a supersedeas bond, it means you’re appealing the outcome of civil litigation. In order to put checks and balances on the justice system, people have the right to appeal a decision rendered in a court of law. However, the courts have the right to refuse to hear that appeal until you obtain a supersedeas bond. Since everything depends on you having a bond, you need to make acquiring one your top priority. Follow this quick guide.

What is a Supersedeas Bond?

Essentially, it’s a guarantee that you will pay for any judgments ordered by the courts. Before a court agrees to hear your appeal, it requires you to obtain one of these bonds. Then, if the appeals court rules against you and you refuse to pay the judgment, the plaintiff to whom that judgment is owed can file a claim against the bond for financial compensation. By holding plaintiffs accountable for their debts, supersedeas bonds – also known as appeal bonds – discourage plaintiffs from filing frivolous appeals for the sole purpose of trying to delay or avoid paying a judgment.

Who Needs a Supersedeas Bond?

Courts often require plaintiffs (and on rare occasion defendants) to prove they have a bond before the appeal proceeds, but it’s not a universal requirement. The court will make it clear when and if you require a bond and in what amount. At that point, your next step should be seeking out a bond provider who can get you a bond fast and meet all the conditions of the court. There’s no advantage to waiting.

What is Your Role in a Supersedeas Bond?

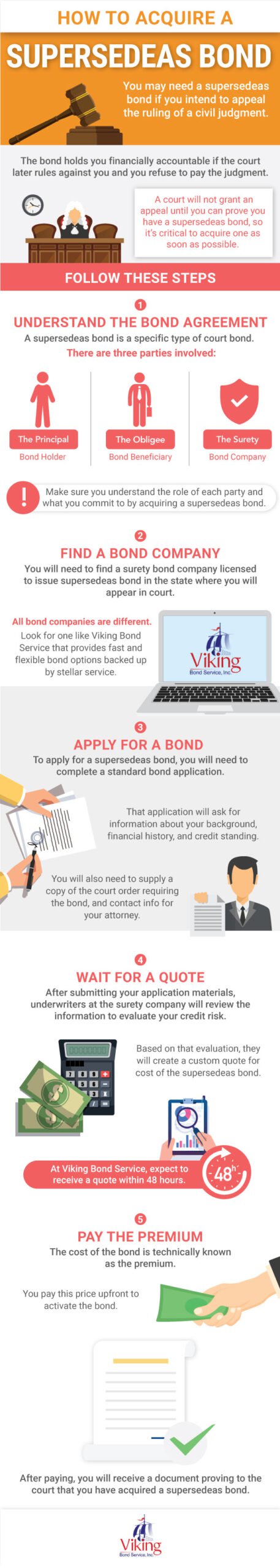

Before you acquire a supersedeas bond, or any kind of surety bond for that matter, it’s important to understand what role you play in the bond agreement and what sorts of obligations you’re committing to. The best way to explain that agreement is by outlining the three parties involved:

- Principal – Whoever obtains the bond. The principal (likely you) pays a premium to take out a bond in a specific amount in their own name, and they agree to pay for any claims filed against that bond, which in the case of supersedeas bonds means agreeing to pay any court-ordered judgments in full.

- Obligee – Whoever requires the bond. The courts are the obligee since they create and enforce the bond requirement. If the principal fails to pay for a judgment – along with any associated court costs and attorney’s fees – the obligee can file a claim for financial compensation against the bond. If the claim is upheld, the courts will then turn the funds over to the defendant to settle the judgment.

- Surety – Whoever issues the bond. The surety issue a bond to the principal and investigates any claims filed against the bond. If the principal fails to pay a valid claim, the surety agrees to cover the costs, but then they have the right to collect that same amount, plus interest and fees, from the principal. Because the surety guarantees payment, defendants will always receive compensation for judgments and plaintiffs will always held accountable – preserving the integrity of the appeals process.

How Do You Acquire a Supersedeas Bond?

By working with the right surety company. It’s the most important decision you will make throughout this process. Look for one like Viking Bond Service that can issue bonds nationwide and has a reputation for excellence. Once you select a surety, you will submit a standard bond application with information about your personal and business finances, along with any related court documents, and the name of your attorney. Underwriters at the surety will use that information to calculate a bond premium and determine your collateral obligation before quoting you a premium price and terms. Once you satisfy the surety’s requirements, you activate the bond and receive proof of such to provide the courts.

What Will a Supersedeas Bond Cost?

That depends entirely on the size of the judgment the bond covers. For example, if you’re appealing a $100,000 judgment, you need a bond in the same amount. The bond premium costs just a fraction of the bond amount, but most supersedeas bonds require collateral as well, meaning you need to stake personal property worth the same amount as the bond. There are also state statutes outlining how the courts must calculate bond amounts and capping them in many cases, so bond costs vary across the country. The best way to explore what a supersedeas bond costs is to apply for one with a leading surety committed to keeping rates as low as possible.

Acquire a Supersedeas Bond From Viking Bond Service

You want to focus on your appeal, not on your bond. Make thing easy on yourself by working with Viking Bond Service. We have experts on hand to answer all your questions and explain your bond in detail. We also offer a streamlined application process designed to get applicants approved for a bond and on with their appeal ASAP. Find everything you need from beginning to end by navigating from our homepage. Whether you need to get information, ask questions, or complete an application, access everything online through Viking Bond Service.