Performance bonds are a type of surety bond that help contractors manage risks and make sure the job is done right. In 2750 BC, the pioneering historian Herodotus reported the use of performance bond agreements as a form of surety. Today, across public and private sectors alike, performance bonds are used by owners to ensure that contractors are up to the task. The extra security that a surety bond offers is an important part of a successful project.

When the contractor fails to deliver based on the terms and conditions of the contract, a performance bond protects the owner from the monetary losses that are incurred. Though they are not insurance, surety bonds such as these provide peace of mind to project owners who have a lot at stake. Let’s dive into the process of acquiring a surety bond, as well as some examples of performance bonds in action.

What is a Surety Bond?

Surety bonds are formal agreements between three parties. Here are their roles:

- The principal is the party who obtains the bond and must meet the conditions of the bond. If those conditions are not met and a claim is filed, the principal (typically the contractor) has to pay to settle those claims.

- The obligee is the party who is protected by the bond. They create the bond requirement, set the bond conditions, and receive financial compensation for any valid claims filed against the bond.

- The surety is the party that issues the bond and guarantees payment. If the obligee files a claim because performance expectations were not met, the surety will investigate whether that claim is valid. If so, they will pay the obligee the amount of the claim (up to the total of the bond). Then the surety will collect that same amount from the principal, the party that triggered the claim and accepted the financial responsibility.

Performance bonds are one example of surety bonds, but there are dozens of others, from lost title bonds to motor vehicle dealer bonds. The three-party arrangement is always the same, but the terms and conditions of the bonds can vary widely.

Why Do You Need a Surety Bond?

First and foremost, because having surety bonds like a performance bond are often a requirement for being hired onto a job. It’s the cost of doing business, and without a bond there are few opportunities to find work. But don’t think of surety bonds as entirely a burden, either. All contractors understand that construction projects of any size are complicated and unpredictable. Surety bonds give the stakeholders behind those projects the confidence that the people they hire will meet performance benchmarks and take responsibility if they don’t. Because of this reassurance, developers, financiers, and homeowners feel more confident investing in renovations or new construction, which ultimately creates more work opportunities for everyone in the industry. Surety bonds in the form of performance bonds are good for everyone.

Determining When to Use a Surety Bond

Many project owners require contractors to provide a performance bond in order to secure a contract. Construction projects commonly utilize performance bonds as a way to make sure that building contractors deliver what they were hired to do in a satisfactory way. Whether you are a project owner or a contractor, knowing how to utilize performance bonds is a must to engage in competitive professional services. Whenever you have a project or provide a service that needs some extra security, a performance bond is worth looking into.

Examples of Performance Bonds in Action

The easiest way to understand how performance bonds work is to consider an example in action. Imagine a homeowner hires a general contractor to build an addition onto his house. The work needs to be done in three months. If it’s not, the homeowner wants to be compensated a certain amount for every day the delay drags on. Performance bonds make this agreement formal. The contractor (the principal) would contact a surety company (like Viking Bond Service) to obtain a bond that meets the conditions established by the homeowner (the obligee). If the work went 5 days over, the homeowner would submit a claim to the surety, which the surety would pay after an investigation. The final step would be the principal paying back the surety.

How to Get a Surety Bond

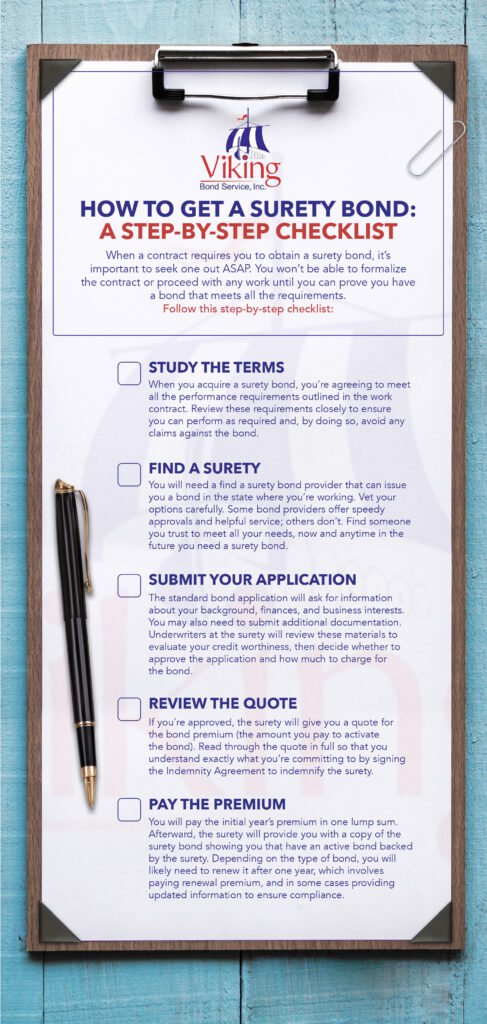

The first step in acquiring a surety bond (such as a performance bond) is to get in touch with a professional agent or bond broker. They will establish a relationship with the contractor to determine their surety capacity and offer expert assistance wherever it’s needed in the contract process. Once the contractor understands the needs of the project at hand, they can submit their requirements to a surety company.

Factors that Matter When You Apply for a Bond

When you apply for a performance bond you will need to submit an application and supply whatever information the surety requests. What that includes will depend on the size of the bond. For smaller bonds, you may only need to supply basic information about your personal finances. For larger surety bonds, you may also need to describe your construction experience and project history, list any other bonded projects you’re working on, and provide financial and liquidity statements. In all cases, the information you provide is used to determine your credit risk and evaluate how likely you are to pay the surety back for any claims it settles. Applicants with bad credit scores may not be denied, but they will pay higher premiums.

Performance Bonds in All 50 States

Viking Bond Service provides a hassle-free approach to performance bonds, giving contractors and project owners confidence in the successful completion of their job. Get started with our online surety bond application to get the process started today. Our easy quoting process and fast turnaround time means you can get your project bonded in a superior way. If you have any questions about performance bonds or the surety bond process, feel free to contact us. And if you would like to learn more about how this entire process works, please explore this free resource all about surety bonds.