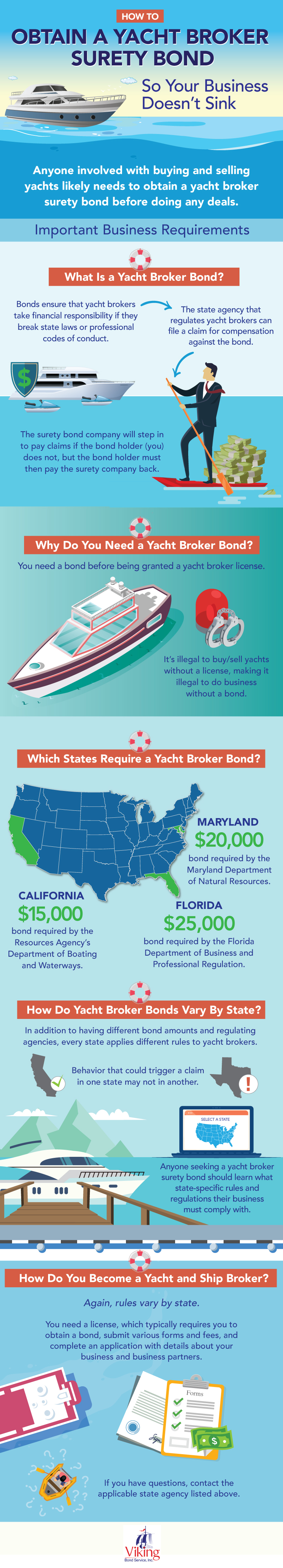

Anyone involved with buying and selling yachts likely needs to obtain a yacht broker surety bond before doing any deals. Here’s an easy overview of this important business requirement:

Share this Image On Your Site

What Is a Yacht Broker Bond?

Bonds ensure that yacht brokers take financial responsibility if they break state laws or professional codes of conduct. The state agency that regulates yacht brokers can file a claim for compensation against the bond. The surety bond company will step in to pay claims if the bond holder (you) does not, but the bond holder must then pay the surety company back.

Why Do You Need a Yacht Broker Bond?

You need a bond before being granted a yacht broker license. It’s illegal to buy/sell yachts without a license, making it illegal to do business without a bond.

Which States Require a Yacht Broker Bond?

- Florida – A $25,000 bond required by the Florida Department of Business and Professional Regulation.

- California – A $15,000 bond required by the Resources Agency’s Department of Boating and Waterways.

- Maryland – A $20,000 bond required by the Maryland Department of Natural Resources.

How Do Yacht Broker Bonds Vary By State?

In addition to having different bond amounts and regulating agencies, every state applies different rules to yacht brokers. Behavior that could trigger a claim in one state may not in another.

Anyone seeking a yacht broker surety bond should learn what state-specific rules and regulations their business must comply with.

How Do You Become a Yacht and Ship Broker?

- Again, rules vary by state.

- You need a license, which typically requires you to obtain a bond, submit various forms and fees, and complete an application with details about your business and business partners.

- If you have questions, contact the applicable state agency listed above.