A contractor bond is one of the most common types of surety bonds. Hundreds of thousands of Americans either have or need to get one of these bonds, which can fall into many different subcategories we will explore later. With something so important, it’s crucial to understand the ins and outs, know how these surety bonds affect you and your finances, and have a plan to obtain a surety bond if and when you need one. Read on.

Contractor Bond Definition

Contractor bond is actually a broad term that describes a variety of different kinds of surety bonds that contractors and construction companies may need to obtain. Surety bonds like these hold a contractor accountable if he or she doesn’t meet standards for quality, timeliness, cost controls, or others outlined within the work contract. The specifics vary widely depending on the type of surety bond, the state, and the circumstances. However, the fundamental principle of contractor surety bonds is always the same: guaranteeing that a contractor takes financial responsibility after failing to meet expectations.

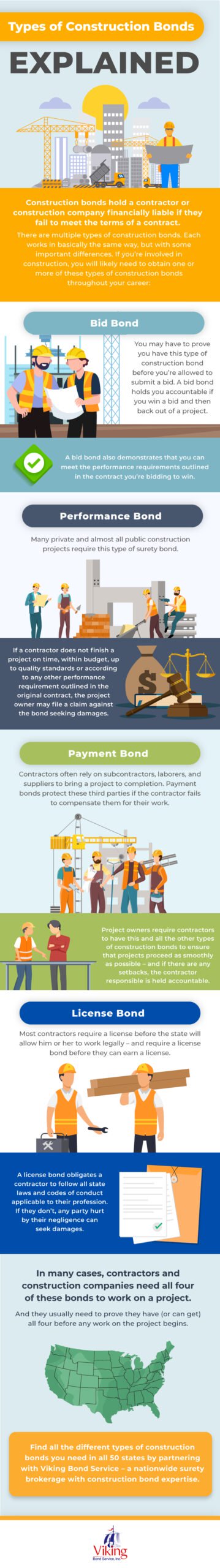

Types of Contractor Bonds

Most of these surety bonds fall into one of five categories:

Bid Bond – Obligating a contractor to follow the terms of a bid

Payment Bond – Obligating a contractor to pay all subcontractors and material suppliers

Performance Bond – Obligating a contractor to meet specific performance standards

Warranty Bond – Obligating a contractor to honor the terms of a warranty

License Bond – Obligating a contractor to follow state licensure requirements

How Does a Contractor Bond Work?

In the event that a contractor doesn’t follow the terms of the work contract, the party who has been negatively affected by that contractor’s actions may file a claim against the surety bond seeking financial compensation equal to the cost of the damages. In a performance bond agreement, for example, if a contractor agrees to complete a project in 100 days and it takes 120 days, the other party in the surety bond agreement (called the obligee) may seek damages to cover the cost of the delay. The surety company that issues the bond agrees to settle (pay) any valid claims, after which they will seek to collect that same amount (plus interest and fees) from the contractor who holds the surety bond and triggered the claim. A surety company will always guarantee payment, but they will also always hold the bonded party financially responsible.

How does a Contractor Bond Benefit the Obligee?

Contractor surety bonds give the obligee – typically the party that hired the contractor, or the municipality that issued the contractor’s license – a way to seek justice and financial compensation if a contractor doesn’t do what he committed to doing. In addition to making the obligee whole, surety bonds offer a way to hold contractors accountable for improper business practices.

How does a Contractor Bond Benefit the Principal?

The principal – the term for the contractor who is the bonded party – must pay for the bond and for any claims filed against it. Despite the personal cost, however, the principal benefits from this arrangement too. That’s because surety bonds build trust between the obligee and the principal, which translates into more work for contractors. Ultimately, bond agreements are good for all involved.

Who Can Get a Contractor Bond?

Anyone who applies for one, gets approved, and pays the premium. To apply you will need to submit a standard surety bond application. That application will ask for information about your business, background, and finances. You may also need to supply additional documentation to help the surety bond company understand your financial standing and credit risk. The cost of a contractor bond can vary depending on whether or not you are considered a credit risk. Upon being approved, the surety bond company will quote you a price to to issue a bond with a 12-month term, or longer when applicable.

Do You Need to Renew a Contractor Bond?

In some cases yes and in other cases no. With a contractor’s license bond, you will need to have an active surety bond to maintain a valid license, meaning you will have to renew the bond annually. Renewal involves having your credit re-evaluated (which could raise or lower your premium price) and paying the premium again. With something like a performance bond, where the bond is tied to the outcome of a specific project, a contractor won’t need to renew the bond once the project concludes.

Viking Bond Service – A Partner to Contractors Nationwide

Contractor bonds are a hugely important business consideration for contractors, but they’re not the primary focus. From a contractor’s perspective, surety bonds should be affordable, accessible, and easy to manage. That’s why so many contractors work with Viking Bond Service, a nationwide surety agency helping all contractors find the surety bond they require. Complete a bond application at any time to get a no-obligation quote, or contact our team at 1-888-278-7389.