Share this Image On Your Site

How Surety Bonds Work in Construction

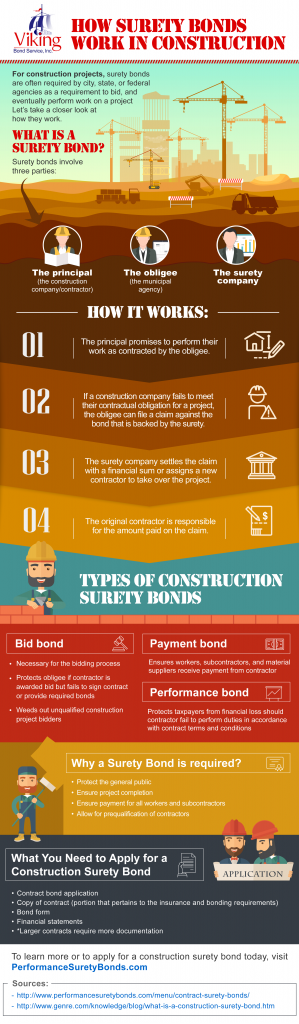

For construction projects, surety bonds are often required by municipal agencies and instill confidence in your company. Let’s take a closer look at how they work.

What is a Surety Bond?

Surety bonds involve three parties:

- The principal (the construction company/contractor)

- The obligee (the municipal agency)

- The surety company

How it works:

1. The principal promises to perform their work as contracted by the obligee.

2. If a construction company fails to meet their contractual obligation for a project, the public or the government agency can file a claim to the surety company.

3. The surety company settles the claim with a financial sum or assigns a new contractor to take over the project.

4. The original contractor is responsible for the amount paid on the claim.

Types of Construction Surety Bonds

- Necessary for the bidding process

- Protects obligee if contractor is awarded bid but fails to sign contract or provide required bonds

- Weeds out unqualified construction project bidders

- Ensures workers, subcontractors, and material suppliers receive payment from contractor

- Protects taxpayers from financial loss should contractor fail to perform duties in accordance with contract terms and conditions

Why a Surety Bond is required?

- Protect the general public

- Ensure project completion

- Ensure payment for all workers and subcontractors

- Create easy transition from financing construction to permanent financing

- Allow for prequalification of contractors

What You Need to Apply for a Construction Surety Bond

- Contract bond application

- Copy of contract (portion that pertains to the insurance and bonding requirements)

- Bond form

- Financial statements

*Larger contracts require more documentation

To learn more or to apply for a construction surety bond today, visit PerformanceSuretyBonds.com