How can I get a surety bond with bad credit? That’s a question we hear a lot. Plenty of people have less-than-stellar credit, often because of mistakes that happened a long time ago. Nonetheless, many surety bond companies won’t work with applicants who have bad credit. Making matters worse, being unable to get a surety bond makes it difficult and often impossible for a contractor to win bids and find work. This becomes a vicious cycle where past financial mistakes make it harder to build a sound financial future. Fortunately, it doesn’t have to be this way. Some companies offer a bad credit surety bond program specifically for people who have a credit score below 700 or something like a bankruptcy on their record. No matter what your current credit is like, read this blog to understand how it will affect your ability to get bonded and what you will pay for that privilege.

Why Do Surety Bonds Require a Credit Check?

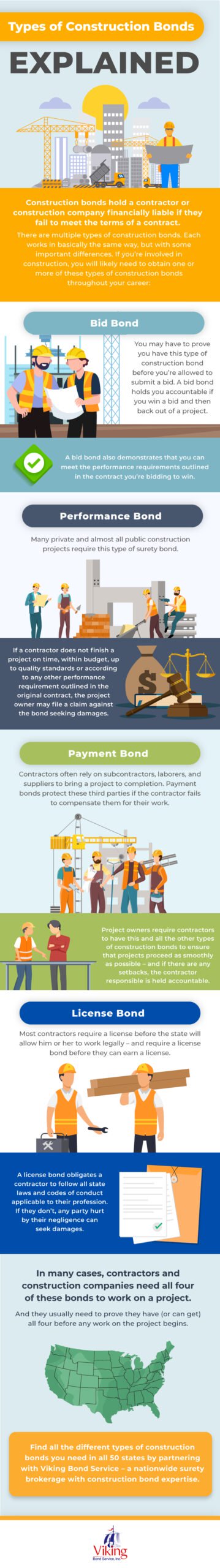

To answer that question, it helps to understand how surety bonds work in the context of a contract performance bond. When a contractor gets hired to perform a job, contact performance bonds hold him financially accountable if he fails to meet performance standards (for time, cost, quality etc.) established in the work contact. If the contractor can’t or won’t accept that financial responsibility, the surety company that issues and backs the bond agrees to pay for any valid claims for damages – after which the bonded party (the contractor) must pay for the damages plus interest and fees.

A surety company runs a credit check to help determine how likely a bond applicant is to engage in behaviors that could lead to claims on the bond. The surety is also trying to determine whether a contractor will pay for those claims, either immediately or after the surety steps in to pay. Essentially, the surety uses the credit check to gauge the risk of approving someone for a bond. Credit checks aren’t a perfect indicator, though, because many people with bad credit are financially responsible as well. That’s why some surety companies like Viking Bond Service have a bad credit surety bond program designed to help more people get the bonds they need regardless of their credit.

How to Avoid Paying Too Much

When deciding how much is too much to pay for a surety bond, keep in mind that surety bonds are essential business expenses. In the same way that contractors require tools and materials to complete a job, they require a bond, and if they don’t have one they can’t secure any business. Seasoned contactors understand this, plan for the bond costs, and then work these costs into the bids they submit for jobs.

The best way to avoid paying too much, especially if you have less-than-perfect credit, is to work with the right surety bond provider. Every company is different. Some are more tolerant of risk than others, and each interprets a bond applicant’s credit score and financial history differently. You could apply for various kinds of contract performance bonds and payment bonds, specifically the trio contractors need for most jobs (bid, performance, and payment bonds), with multiple companies and compare the various offers. But that would be a lengthy process, and when you’re trying to win a bid, time is of the essence. The better move is to work with Viking Bond Service – a nationwide surety brokerage offering what’s known in the industry as a bad credit surety bond.

For all intents and purposes, a bad credit surety bond is just like any other surety bond. The only difference is that the applicant has bad credit and may have been denied a bond by other providers. At Viking Bond Service, we use our coast-to-coast connections, years of experience, and abundant resources to help more contractors get the bonds they require at affordable, competitive rates. Working with the right surety bond provider is the single best thing you can do to keep bonding costs in check. And if you think you’re paying too much with your current provider, investigate how much you could potentially save by switching.

How to apply for Small Contract Performance Bonds and Payment Bonds?

If you need bonds to complete a contract valued at less than $350,000, applying is easy. You will submit a bond application, which takes only a few minutes to complete and asks for information about your background, business interests, and financial strength. You will also need to submit to a credit check and turn over any other documentation the underwriters (risk assessors) need to evaluate your bond worthiness. Based on that information, they will quote you a price for the bond premium. Having bad credit will mean paying a higher premium, but not exorbitantly high. Applicants with good or bad credit will both pay a small percentage of the total bond amount.

Viking Bond Service – Our Bad Credit Surety Bond Program

There’s a reason contractors in all 50 states make Viking Bond Service their go-to bond partner. Unlike other bond providers, we make a real effort to make bonding fast, easy, and affordable for everyone we work with. If you have questions about surety bonds or your credit, get immediate answers from one of our bond experts – call 1-888-278-7389 or submit your question through the contact form on this page. You can also apply for a bad credit surety bond at any time, and expect to receive a quote in under 24 hours. Complete this online application!

![A Guide to Bid Bonds [Infographic]](https://www.performancesuretybonds.com/blog/wp-content/uploads/2020/10/Screen-Shot-2020-10-30-at-2.23.48-PM.png)